LONDON: While the creation of a “Strategic Bitcoin Reserve” in the United States is proof of President Donald Trump’s support for the cryptocurrency sector, there are misgivings about the move, with some blaming the US government for not returning bitcoin to all victims identified as suffering from a hack.

Trump signed an executive order earlier this month establishing the reserve that White House crypto chief David Sacks likened to “a digital Fort Knox”, comparing it to the stockpiling of gold bars at the US military base.

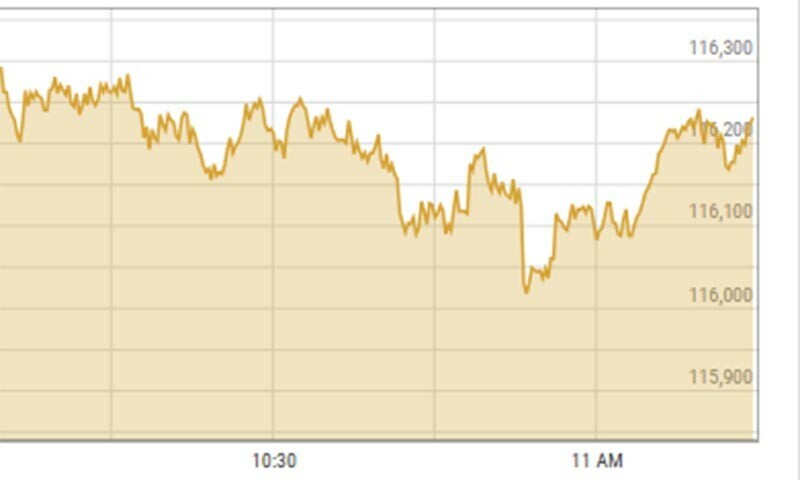

Gold is held in reserves by countries worldwide as the metal is seen as a safe-haven asset, protecting against financial instability such as high inflation.

The metal surpassed $3,000 per ounce for the first time, boosted by an uncertain economic outlook amid Trump’s tariffs.

Gold reserves can help also stabilise a country’s currency, while bars are used as collateral for loans and transactions.

How will US bitcoin reserve work?

It is to be funded by about 200,000 bitcoins, worth around $17 billion, that have been seized in the US as a result of civil and criminal cases.

More bitcoin can be added to the reserve as long as such action is “budget-neutral”.

The price of bitcoin initially slid after Trump signed the executive order but has since stabilised.

Dessislava Aubert, an analyst at crypto data provider Kaiko, told AFP that “legally” the US government must return bitcoin to all victims identified as suffering from a hack.

According to Aubert, “a big chunk” of the bitcoin held by the US — estimated at 198,000 tokens — would have to be returned to victims of a hack at crypto exchange Bitfinex in 2016.

Sector watchers are also waiting to see if other digital tokens will be added to the reserve, which is possible according to the executive order.

Trump has said that bitcoin’s nearest rival, Ether, along with three other tokens — XRP, Solana and Cardano — could be added.

Critics point out that unlike gold, cryptocurrencies are risky assets and have no intrinsic value.

However, White House crypto chief David Sacks believes that by storing bitcoin over time, the government would protect itself from the cryptocurrency’s volatility.

Meanwhile, Stephane Ifrah, an investment director at crypto platform Coinhouse, said bitcoin, like gold, can profit from its rarity thanks to a limited 21 million tokens.

Bitcoin reserve advantage is transparency, as the level of tokens will be known at all times, unlike the amount of gold placed in Fort Knox.

Published in Dawn, March 17th, 2025