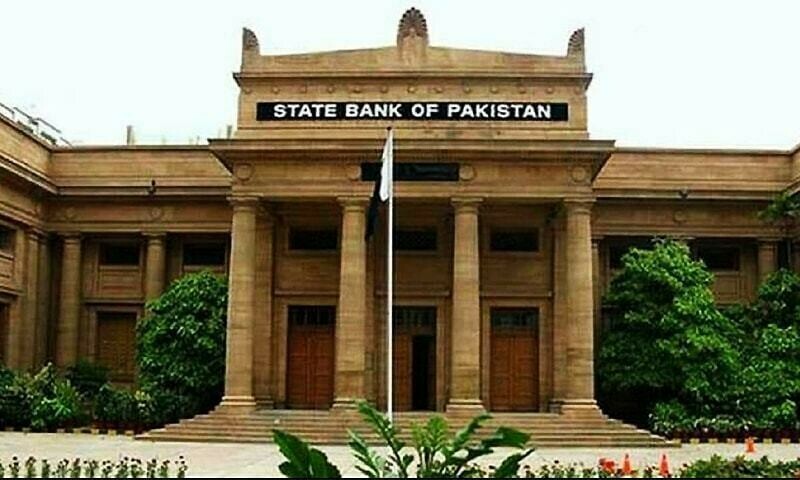

The State Bank of Pakistan (SBP) announced on Monday that it has decided to keep the policy rate unchanged at 12 per cent, assessing the current real interest rate to be adequately positive on the forward-looking basis to sustain the ongoing macroeconomic stability.

The central bank’s policy rate, after being slashed by 1,000bps from 22pc since June 2024 in six intervals, now stands at 12pc.

February inflation stood at a near-decade low of 1.5pc, largely due to a high base a year ago.

A Reuters survey of 14 analysts suggests that the central bank may further reduce rates, with a median forecast for a cut of 50 bps.

Of the 10 analysts expecting a rate cut, three estimated its size at 100 bps, one at 75 bps, and six at 50 bps. The rest saw no change.

Most analysts expecting a rate cut believe the central bank will stop when rates hit 10.5pc to 11pc, due to a potential rise in inflation. They anticipate a moderate rise from March to May.

Inflation will “bottom out” in the year’s first quarter before gradually rising, said Ahmad Mobeen, senior economist of S&P Global, who anticipates average inflation of 6.1pc for 2025.

Despite the “sharp drop” in the Consumer Price Index (CPI), he said urban core inflation, indicative of price pressures, remained high, at 7.8pc.

At its last policy meeting, the central bank kept its forecast of full-year GDP growth at 2.5pc to 3.5pc, and predicted faster growth would help boost foreign exchange reserves that had been lacklustre.

“While GDP posted 0.9pc growth in the first quarter of fiscal year 2025, large-scale manufacturing remains in negative territory, and production has yet to gain momentum,” said Sana Tawfik, head of research at Arif Habib Limited.

“The transmission of lower rates to economic activity is yet to be seen.”

The target was only possible if industrial activity picked up and agricultural output improved, she added.