Donald Trump’s reciprocal tariffs impact on India: US President Donald Trump has announced that on April 2, 2025, America would impose reciprocal tariffs on countries that levy higher duties on American goods. During his address to Congress, Trump criticised India and other nations, including China, for their “very unfair” tariff practices.

So what will be the impact of Trump’s reciprocal tariffs on India? According to a recent report by Nomura, India is among the least vulnerable Asian countries in this trade war.

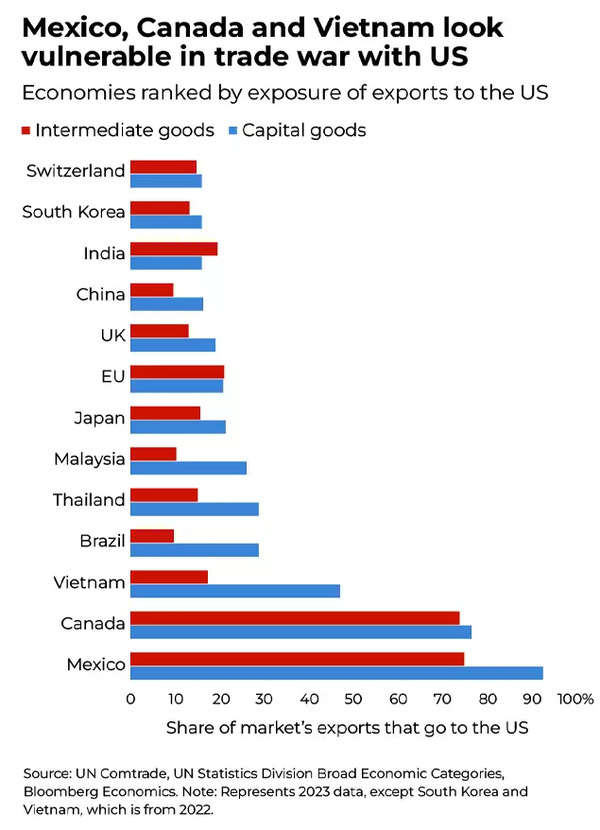

The economies of Vietnam, Taiwan, Thailand and Malaysia, which maintain comparatively unrestricted trade policies, face significant vulnerability to increased US customs duties. Among Asian nations, Vietnam stands particularly susceptible, as its US-bound exports constitute 25% of its gross domestic product.

As is evident from the chart, India’s exports to the US as a percentage of the former’s GDP is just 2.2%, compared to 25.1% for Vietnam, hence indicating relatively lesser exposure.

Which countries are more vulnerable to US tariffs?

Analysis of Asia’s value addition in global exports to the United States by Nomura reveals Vietnam as the most vulnerable to comprehensive US tariffs (8.9% of its GDP). This is followed by Taiwan (6.3%), Thailand (5.6%), Malaysia (4.6%), Singapore (4.5%) and South Korea (4.5%). The computer & electronics industry faces the highest risk from supply-chain disruptions caused by tariffs.

Trump’s proposed tariff measures include various sectors including semiconductors, pharmaceuticals, steel, aluminium, lumber and forest products, with copper potentially being added to the list.

The impact on Asian exports to the United States is substantial, with 20.6% of the region’s US-bound shipments facing potential disruption. Several Asian economies show significant vulnerability, as more than 25% of US-directed exports from South Korea, Japan, Malaysia, the Philippines and Taiwan could face these sectoral tariffs.

In terms of sectoral analysis, Asian economies demonstrate highest exposure to automotive tariffs, whilst semiconductor and steel sectors rank as the second and third most vulnerable areas respectively.

What Donald Trump has said:

“Other countries have used tariffs against us for decades and now it’s our turn to start using them against those other countries. On average, the European Union, China, Brazil, India, – Mexico and Canada – Have you heard of them – and countless other nations charge us tremendously higher tariffs than we charge them. It’s very unfair,” Trump stated in his longest speech to the Joint Session of Congress on Tuesday evening.

He specifically highlighted that “India charges us auto tariffs higher than 100 per cent.”

The implementation of increased tariffs on Indian exports (including pharmaceuticals, textiles, and IT services) would increase their costs in the US market, potentially reducing demand. This could negatively impact Indian manufacturers and exporters whilst increasing prices for US consumers.

As a counter-measure to US tariffs, India might seek to enhance its economic relationships with alternative global partners such as the European Union, China, or Russia to offset reduced US market access. This development could diminish American economic influence.

Trade Relations between Asia and United States

Analysing sector-wise exposure, electronic components, machinery, automobiles and other manufactured items face elevated US customs duties.

- Vietnamese shipments to the United States constitute 25% of its GDP, primarily comprising textiles and electronic goods.

- Electronics make up over 60% of both Taiwanese and Malaysian exports to the United States.

- Thailand faces broader vulnerability across electronics, rubber-based products and machinery exports.

- Other Asian nations show varied export portfolios to the US market. Singapore sends approximately 14% in chemicals and pharmaceutical products, whilst India’s primary exports include precious stones, textiles and pharmaceutical items.

What Trump’s Tariffs may mean for Asia

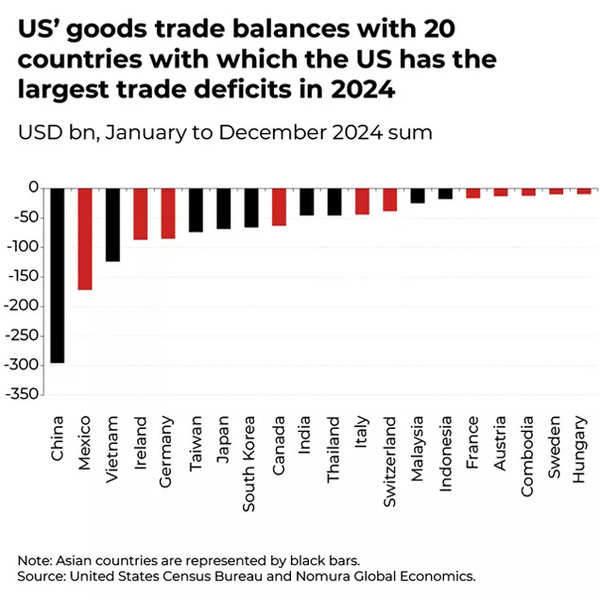

1. Regional Effect: China stands as the primary focus of America First Trade Policy (AFTP), whilst other Asian nations face significant risks. The US tariff strategy encompasses trade deficits, reciprocal and sectoral duties, alongside potential penalties for nations involved in tariff evasion. Regarding trade imbalances, Asia maintains a substantial surplus with the US.

Amongst the top 11 nations with US trade deficits, seven are Asian: China (1), Vietnam (3), Taiwan (6), Japan (7), South Korea (8), India (10) and Thailand (11).

US’ goods trade balances

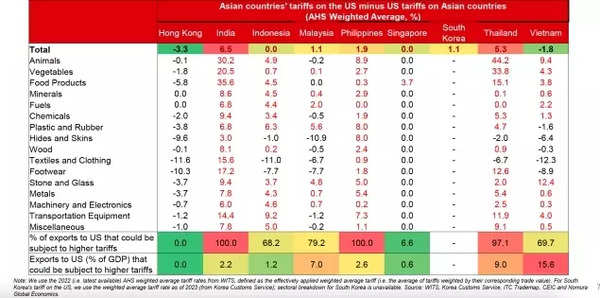

2. Reciprocal Tariffs: The implementation of reciprocal tariffs considers tariff differentials, VAT and non-tariff obstacles. Developing Asian nations, particularly India and Thailand, maintain higher comparative tariff rates on US exports, notably in agricultural and transport sectors. Including non-tariff barriers in assessment criteria increases the possibility of reciprocal taxation across various Asian economies, both emerging and developed.

3. Sector-specific Duties: The proposed tariffs target semiconductors, pharmaceuticals, steel, aluminium, lumber and forest products (potentially copper), comprising 20.6% of Asian exports to the US. For Korea, Japan, Malaysia, the Philippines and Taiwan, these sectoral tariffs could affect over 25% of their US exports. Asian exposure is highest in automobiles, followed by semiconductors and steel.

4. Semiconductor tariffs: Detailed analysis indicates minimal direct consequences of increased chip tariffs on Asia, considering limited US substitution options. However, indirect effects present greater concerns, as reduced US consumer demand would affect Asian economies across various electronics supply chain stages. Taiwan shows the highest vulnerability, followed by Malaysia, Singapore, Korea, Thailand and Vietnam.

5. Third country risk: Should the US administration implement tariffs on imports from countries potentially circumventing existing duties, specific products from Vietnam, Malaysia and Thailand could face scrutiny, as these nations show higher Chinese value addition in their US-bound exports. Since India’s share of China value added in their goods exports to the US is relatively less, there is lower expected impact.

6. Indirect effects: Asian nations are deeply integrated into global supply networks, encompassing both backward linkages (where foreign value is incorporated into domestic exports) and forward linkages (where domestic value is incorporated into foreign exports). As a result, Asia’s actual exposure to the United States – considering both direct and indirect value addition through third countries – is substantially higher.

Role of Reciprocal Tariffs

Retaliatory or reciprocal tariffs shall be determined by considering multiple elements including tariff differentials, value-added tax and non-tariff restrictions.

Asian developing economies, particularly India and Thailand, apply elevated comparative tariff rates on American exports, making them vulnerable to increased reciprocal tariffs.

Asian countries’ tariffs on the US minus US tariffs on Asian countries

Across industries, Asian nations levy steeper duties on farm products and transport items. Whilst reducing agricultural tariffs remains politically challenging for Asian countries, they could consider lowering duties in the transport sector, including automobiles.

How India is prepping for Trump 2.0

- According to the Nomura report, India intends to secure a comprehensive trade and investment agreement with the United States, as India stands ready to reduce tariffs on select items (e.g. pork, high-end medical devices, luxury motorcycles) and extend substantial benefits including production-linked incentives for shipping and backing for logistics enterprises.

- India seeks to enhance procurement of defence equipment, aircraft, oil & gas, technology and medical & diagnostic equipment from the United States.

- The aim is to position India as a viable manufacturing alternative to China, offering enhanced benefits such as tax reductions and land accessibility in states like Andhra Pradesh, Gujarat and Tamil Nadu across sectors including semiconductors, electronics, aircraft components, and renewables.

- India aims to become part of US global supply networks by providing concessions to American companies utilising India as a production centre for basic/intermediate goods (e.g. low-end chips, solar panels, machinery, pharmaceuticals).

- India proposes to increase foreign direct investment limit in insurance to 100% (currently at 74%), potentially benefiting major US insurance companies like AIG.