KARACHI: The Pakistan Stock Exchange (PSX) faced selling pressure on Wednesday due to uncertainty surrounding tax reforms ahead of the first review under the $7 billion Extended Fund Facility, with the International Monetary Fund (IMF) team arriving next week.

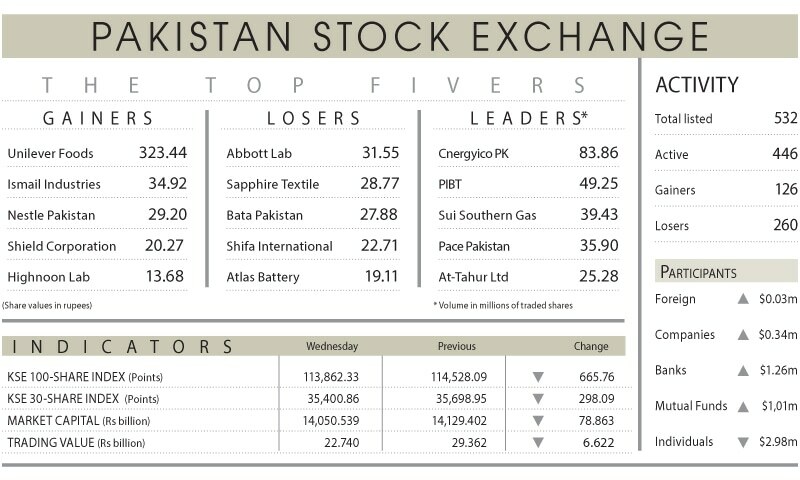

Topline Securities Ltd noted that after two days of strong buying by local mutual funds, the market took a breather as investors opted for profit booking, resulting in a volatile session. The benchmark KSE 100 index fluctuated between an intraday high of 234 points and a low of 678 points before settling at 113,862, down 665 points or 0.58pc day-on-day.

The downward movement was primarily driven by Engro Holdings, Oil and Gas Development Company, Pakistan Petroleum, Mari Energies, and PSO, which collectively shaved 417 points off the index.

Hub Power announced its financial results for 2QFY25, reporting earnings per share of Rs3.25, which fell short of expectations due to lower gross profits and higher other expenses. However, the company declared a Rs5 per share dividend, exceeding industry estimates.

Ahsan Mehanti from Arif Habib Corporation stated that stocks closed lower due to uncertainty regarding the outcome of the IMF talks on technical matters, policy, and approvals for the FY26 federal budget proposals.

He added that weak global equities and crude oil prices amid geopolitical risks contributed to the bearish close.

Ali Najib, Head of Sales at Insight Securities, the decline in international oil price in the backdrop of dialogues initiation between global super powers regarding Ukraine situation, put some pressure on local oil and gas companies.

However, the market activity remained strong as the trading volume rose 29.07pc to 640.17 million shares while the traded value decreased 22.55pc to Rs22.74bn day-on-day.

Stocks contributing significantly to the traded volume included Cnergyico PK (83.86m shares), Pakistan International Bulk Terminal (49.25m shares), Sui Southern Gas (39.43m shares), Pace Pakistan (35.90m shares) and At-Tahur Ltd (25.28m shares).

The shares registering the most significant increases in their share prices in absolute terms were Unilever Foods, Ismail Industries, Nestle Pakistan, Shield Corp and Highnoon Lab.

Published in Dawn, February 27th, 2025