Bulls maintained a hold of the trade floor at the Pakistan Stock Exchange (PSX) on Monday as shares gained over 1,000 points in intraday trade despite a delay in the International Monetary Fund (IMF) staff-level agreement (SLA).

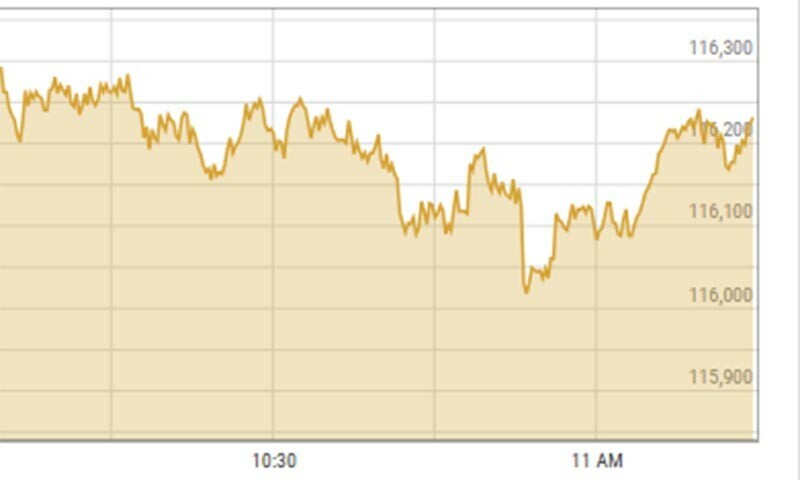

The benchmark KSE-100 climbed 1,027.32, or 0.89 per cent, to stand at 116,563.48 points from the last close of 115,536.16 at 1:01pm. Finally, the index closed at 116,199.59, up by 663.43 points or 0.57pc, from the previous close.

Mohammed Sohail, chief executive of Topline Securities, observed that despite the SLA delay, the market “remained positive amid hope of resolution of old circular debt through banks funding”.

According to a report by Arif Habib Limited, the government made major strides in resolving the power sector’s circular debt of Rs1.5tr.

“As per the news, Rs1.25tr of the total amount will be financed through new loans from banks, while Rs250 billion is already allocated in the budget,” it said, adding that the government is expected to borrow Rs1.25tr from commercial banks under this plan to resolve circular debt in the power sector.

“The commercial banks lending to the government will be at an interest rate of 0.90pc lower than the Kibor [Karachi Interbank Offered Rate],” it said.

Yousuf M. Farooq, director research at Chase Securities, said: “The market is positive on expectations of a smooth staff-level agreement with the IMF.

“Moreover, sentiment remains upbeat due to the anticipated resolution of circular debt and a potential reduction in power tariffs.”

Farooq added that the participants also expected “some improvement in the current account, driven by higher remittances during Ramazan”.

Awais Ashraf, director research at AKD Securities, attibuted the positive momentum to “the IMF mission’s positive remarks on Pakistan’s progress in meeting the Fund’s targets have boosted investor confidence in the imminent signing of the SLA”.

“Meanwhile, energy sector stocks are expected to stay in focus in the coming days, given the increased likelihood of a one-time resolution of circular debt,” he added.

Sana Tawfik, head of research at Arif Habib Limited, said that the market was buoyed on the back of the IMF deal.

Additionally, she said that the news regarding a circular debt resolution also played a critical role in uplifting market sentiment.

Last week, despite a pause in interest rate cuts and a weakening rupee due to declining foreign exchange reserves, the stock market had remained in the green zone for the fifth consecutive week, propelling above 115,000 level after almost two months.

According to AKD Securities Ltd, the week had started on a negative note as the State Bank of Pakistan’s Monetary Policy Committee delivered a surprise status quo in the benchmark interest rate at 12pc coupled with the IMF raising concerns over the government’s plan for resolving Rs1.25 trillion circular debt through commercial bank borrowing, kept investors cautious.

This positive performance was supported by improved investor sentiment following some ‘relaxations’ provided during the first review by the visiting IMF mission.

The market traded within a narrow band of 2,100 points during the week, remaining lacklustre as trading activity was subdued due to Ramazan.